Tariff Update – Reciprocal /IEEPA Tariffs and Section 321 Deminimis for Chinese Goods

Washington, DC, 3 APR, 2025 – President Donald Trump is imposing 10% tariffs on all imports other than those from Canada and Mexico, beginning April 5, 2025. Several countries that White House economists calculated had the highest non-tariff barriers and tariffs, there will be higher tariffs that will go into effect April 9,2025.

These duties will not be on top of current Section 232 Duties for Steel and Aluminum.

According to the presidential Fact Sheet:

- Using his IEEPA authority, President Trump will impose a 10% tariff on all countries.

• This will take effect April 5, 2025 at 12:01 a.m. EDT. - President Trump will impose an individualized reciprocal higher tariff on the countries with which the United States has the largest trade deficits. All other countries will continue to be subject to the original 10% tariff baseline.

• This will take effect April 9, 2025 at 12:01 a.m. EDT. - These tariffs will remain in effect until such a time as President Trump determines that the threat posed by the trade deficit and underlying nonreciprocal treatment is satisfied, resolved, or mitigated.

- Today's IEEPA Order also contains modification authority, allowing President Trump to increase the tariff if trading partners retaliate or decrease the tariffs if trading partners take significant steps to remedy non-reciprocal trade arrangements and align with the United States on economic and national security matters.

- Some goods will not be subject to the Reciprocal Tariff. These include: (1) articles subject to 50 USC 1702(b); (2) steel/aluminum articles and autos/auto parts already subject to Section 232 tariffs; (3) copper, pharmaceuticals, semiconductors, and lumber articles; (4) all articles that may become subject to future Section 232 tariffs; (5) bullion; and (6) energy and other certain minerals that are not available in the United States.

- For Canada and Mexico, the existing fentanyl/migration IEEPA orders remain in effect, and are unaffected by this order. This means USMCA compliant goods will continue to see a 0% tariff, non-USMCA compliant goods will see a 25% tariff, and non-USMCA compliant energy and potash will see a 10% tariff. In the event the existing fentanyl/migration IEEPA orders are terminated, USMCA compliant goods would continue to receive preferential treatment, while non-USMCA compliant goods would be subject to a 12% reciprocal tariff.

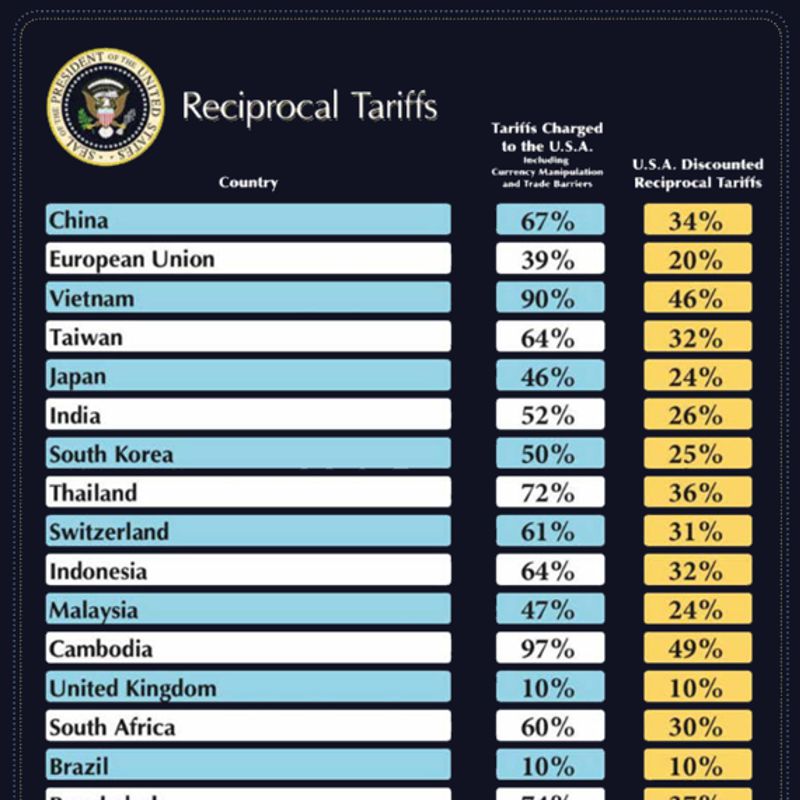

Attached are the lists of all countries subject to Reciprocal Tariffs with their duty rates. Below are a few of the top exporters:

- 34% on Chinese goods

- 20% on EU goods

- 46% on Vietnamese goods

- 32% on Taiwanese goods

- 24% on Japanese goods

- 26% on Indian goods

- 25% on South Korean goods

- 36% on Thai goods

- 31% on Swiss goods

- 32% on Indonesian goods

- 24% on Malaysian goods

- 49% on Cambodian goods

- 30% on South African goods

- 37% on Bangladeshi good

CBP will post further details once they become available. We will update you as soon as we have any information.

Please see here for the Presidential fact sheets. See here for the Reciprocal Tariffs Executive Order

De Minimis Ends for Chinese Goods May 2

An executive order signed by President Donald Trump April 2 ends de minimis treatment for goods from China and Hong Kong starting May 2 at 12:01 a.m., according to a White House fact sheet.

The Commerce Department will provide a report within 90 days assessing the impact of this order, and will recommend whether it should extend to packages from Macau.

These changes are related to the International Economic Emergency Powers Act tariffs announced earlier, and therefore, do not cover books, films, photographs, compact disks and vinyl records, artwork and other informational goods.

Return to Flash News Page...